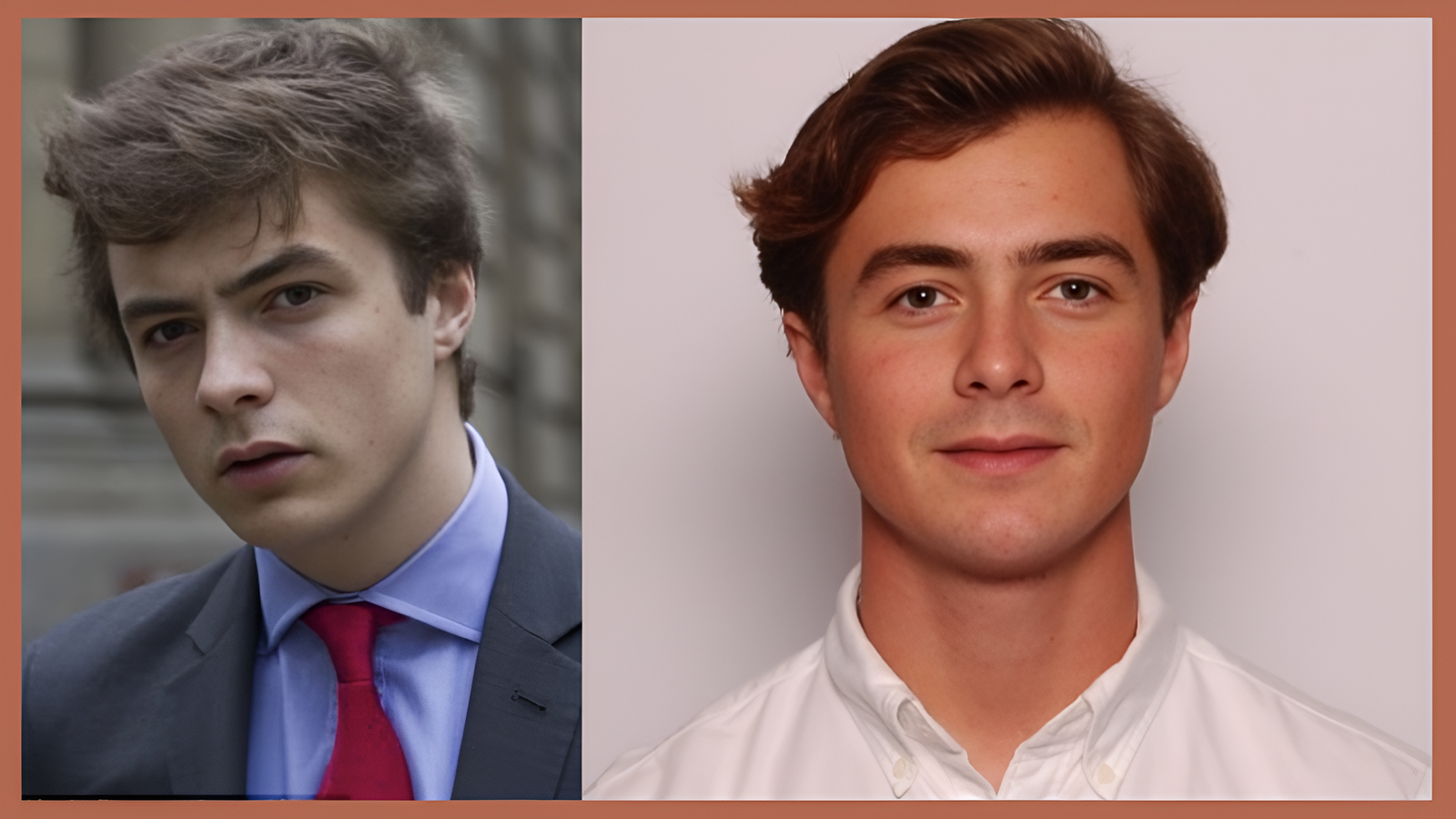

Thomas Farage: Age, School Background, Job Role, and His Career as a Trader

Understanding the story behind any rising professional in the financial world often means assembling the publicly available pieces — their early influences, the environment they grew up in, and the paths that shaped their ambitions. The same is true for Thomas Farage. His name has begun surfacing more frequently in conversations about young finance talent, early-stage traders, and individuals connected to well-known public families. Although details about Thomas Farage’s age, school, job, and the whole progression of his career remain limited, his emerging presence reflects a new wave of professionals entering modern financial markets. They bring with them updated tools, a different way of thinking, and an approach shaped by today’s fast-moving economic landscape. This article pulls together the most reliable information available, presenting it clearly while staying grounded in accuracy and avoiding unnecessary speculation.

Early Life and Age of Thomas Farage

Very little verified information is available about Thomas Farage’s age, mainly because he maintains a private, relatively understated public presence. Unlike long-established figures in finance whose personal histories are widely documented, details such as his birth year or early biographical milestones have not been formally disclosed. What can be gathered, though, suggests that he is part of a younger wave of professionals entering the financial world at a time of significant transformation. Today’s markets are shaped by digital trading tools, faster access to data, and a growing emphasis on financial education — all factors that give modern entrants a very different starting point compared to those who entered the field a generation ago.

Growing up in a time when financial awareness is more readily accessible and global markets are openly discussed on digital platforms, Thomas likely encountered conversations about economics, world trade, and investment risk from an early age. That kind of environment shapes how many modern young traders develop their instincts and long-term goals. Today’s financial landscape rewards people who can study currency movements, understand broader market cycles, and interpret large-scale economic shifts with clarity. These analytical strengths seem to align closely with the qualities associated with Thomas Farage’s emerging professional profile.

Education and School Background of Thomas Farage

Since no verified information about Thomas Farage’s school has been publicly released, it’s essential to recognize that his specific academic path cannot be confirmed. What can be said with confidence, however, is that people who pursue careers in trading usually build their education around subjects like mathematics, economics, finance, or broader business studies. These fields help develop the analytical mindset and problem-solving abilities that are essential for navigating complex financial markets. Many future traders also seek additional training or certifications that strengthen their ability to interpret data, manage risk, and make informed decisions under pressure.

Students who plan to build a future in finance usually begin developing a strong set of skills that support analytical and strategic thinking.

- A solid ability to work with numbers and interpret statistical patterns.

- The capacity to make sound decisions quickly, even when the stakes are high.

- A clear grasp of how broader economic forces work and how different markets tend to react and move over time.

- The ability to read financial reports and understand the models used to guide investment decisions.

Even without knowing the exact schools Thomas Farage attended, it’s clear that anyone preparing for a future in finance needs strong study routines and a solid academic base. Today’s financial world is highly technical, so developing analytical skills early on is essential long before stepping into a professional role. Since Thomas Farage is connected to trading and financial analysis, it’s reasonable to believe that his education encouraged disciplined thinking, an awareness of economic trends, and a genuine interest in how financial systems function.

Career Beginnings and Entry Into Finance

The financial industry is known for its intense competition, and anyone pursuing a career in trading usually goes through rigorous preparation, hands-on learning, and early exposure to real market environments. Although there isn’t much publicly available information about the earliest stages of Thomas Farage’s job journey, the path followed by many professionals in similar roles typically involves structured training, internships, and practical experience that help them understand how markets move and how trading decisions are made.

- Taking on internships or starting out in junior positions at financial firms.

- Gaining hands-on experience with evaluating different types of investments.

- Developing the ability to judge risk accurately and carry out trades with confidence and precision.

- Becoming comfortable with modern trading systems and the software used to track real-time market data.

- Working closely alongside experienced analysts or traders to learn directly from their day-to-day decisions.

Most young traders start out by assisting more experienced teams, managing smaller sets of assets, and taking on tasks that help them build confidence in reading and interpreting the markets. Today’s financial world demands professionals who can adapt quickly, work comfortably with real-time data, and use advanced analytical tools to guide their decisions. This modern, technology-driven environment likely played a major role in shaping Thomas Farage’s early development as a professional, influencing how he thinks, learns, and approaches the trading landscape.

Thomas Farage Job Role in Finance

When looking at Thomas Farage’s job, the information available suggests that he works within the financial world, with trading and market analysis at the core of what he does. Trading itself is a demanding and highly technical profession that blends numerical accuracy, emotional self-control, and forward-thinking strategy. A typical trader’s responsibilities include keeping an eye on global market movements, reviewing financial developments, evaluating the risks tied to each decision, and operating within structured guidelines to maintain discipline and consistency. These qualities reflect the kind of professional environment Thomas Farage is associated with.

Broadly speaking, people in roles similar to Thomas Farage’s are expected to take on responsibilities such as:

- Studying market movements and making sense of the patterns behind them.

- Carrying out trading decisions for clients or financial organizations.

- Evaluating potential risks and making changes to portfolios when the markets become unpredictable.

- Keeping a close eye on economic signals and trends from around the world.

- Sharing clear, well-reasoned updates about market developments with senior colleagues.

The financial sector moves at a fast pace, which means newcomers must adapt quickly and continually build their knowledge. Trading, in particular, calls for a steady mix of theoretical understanding and hands-on decision-making, making real-world practice essential for long-term growth. As part of a younger generation entering the industry, Thomas Farage likely relies on data-focused tools and modern analytical platforms that help him interpret market movements and make clear, timely decisions in a constantly shifting environment.

Thomas Farage as a Trader

The term Thomas Farage trader stands out because trading itself is known to be a demanding, fast-paced line of work. It calls for sharp concentration, a willingness to learn from both success and mistakes, and the discipline to think long-term even when markets shift from one moment to the next. People who enter this field quickly discover that emotional reactions can be costly, which is why strong self-control and steady judgment become essential parts of a trader’s mindset.

Some of the qualities commonly seen in traders of Thomas Farage’s generation include:

- Using solid data to guide decisions instead of depending solely on gut instinct.

- Being comfortable working with modern digital trading systems and advanced algorithmic tools.

- A genuine curiosity about worldwide economic trends and how global markets interact.

- Being ready to adjust quickly whenever new tools or technologies are introduced.

- Continuously building knowledge by paying attention to how markets rise, fall, and evolve over time.

Today’s trading world is shaped heavily by technology, with digital tools guiding nearly every decision a professional makes. Machine learning systems, predictive analytics, and real-time dashboards have become essential parts of daily work in many financial institutions. Because of this, younger traders like Thomas Farage must be able to move confidently between traditional financial judgment and the fast-paced digital tools that now define much of the industry.

Professional Reputation and Public Perception

Thomas Farage isn’t someone who seeks the spotlight, and this low-key presence sets him apart from more publicly documented figures in finance. Because he keeps his personal life and background largely private, most impressions of him come from his work and the professional roles linked to his name. In an industry that often respects discretion, discipline, and a focused attitude, his quiet approach aligns well with the qualities many financial firms value. His reputation, therefore, reflects a career built on professionalism rather than publicity.

The fact that Thomas Farage has no public controversies linked to his name only strengthens his professional reputation. In fields where consistency and dependability matter, maintaining a quiet, drama-free profile is often interpreted as a sign of maturity and focus. Although there isn’t extensive public discussion about him, the impressions that do emerge reflect qualities such as ambition, steady progress, and a growing level of professional skill. His reserved presence fits well within an industry that values stability and disciplined work habits.

Personal Interests and Lifestyle (Within Allowed Topics)

Since there are no confirmed details about Thomas Farage’s personal interests, any description of his lifestyle has to stay general and grounded in what is typical for professionals in his field. Many young people working in finance tend to focus on habits that help them manage stress, stay productive, and continue developing their skills. It’s common for traders and analytical professionals to gravitate toward activities that support clear thinking, personal growth, and a balanced mindset.

- Taking time to understand how economic trends develop across different parts of the world.

- Experimenting with fresh strategies and methods to improve trading performance.

- Strengthening the analytical and numerical abilities needed to make well-informed financial decisions.

- Keeping up with market reports and expert financial discussions to stay informed.

- Building personal growth through habits such as reading, practicing new skills, and learning consistently.

These kinds of habits help traders stay focused, think clearly, and avoid letting emotions take over during fast-moving market situations. Although these tendencies are broad and may not apply to everyone, they are consistently seen among professionals in roles similar to Thomas Farage’s job, reflecting the mindset required to succeed in such a demanding field.

Conclusion

Even though detailed information about Thomas Farage’s age, schooling, job history, and the full progression of his trading career is not publicly available, what is known places him among a newer generation of finance professionals. His involvement in trading points to a path shaped by analytical thinking, awareness of market movements, and a willingness to adapt in a fast-changing industry. His low public profile suggests a deliberate choice to prioritize professionalism over visibility, a trait shared by many modern figures in finance who value performance and consistency more than public attention.

By looking at the industry he operates in, the responsibilities traders typically handle, and the academic grounding that prepares them for this work, it becomes easier to understand where Thomas Farage fits within the financial landscape. As markets grow more complex and technology continues to reshape the industry, professionals like him—those who build strong analytical skills, stay committed to their development, and keep a quiet, focused public presence—are increasingly shaping the future of modern finance.